|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

No Cost Refinance Home Loans: Understanding the Benefits and DrawbacksNo cost refinance home loans have become increasingly popular among homeowners looking to reduce monthly mortgage payments without upfront costs. In this article, we will explore what these loans entail, their benefits, potential drawbacks, and answer common questions. What Are No Cost Refinance Home Loans?A no cost refinance home loan is a type of refinancing where the lender covers the closing costs. This option can be appealing for homeowners who wish to refinance without paying significant fees out of pocket. How Does It Work?In a no cost refinance, the lender either absorbs the costs or adds them to the principal balance. Alternatively, they might charge a slightly higher interest rate to cover these expenses over time. Benefits of No Cost Refinance

Potential DrawbacksWhile attractive, no cost refinance loans can have downsides.

For those with investment properties, comparing options is crucial. Consider exploring the best refinance rates for investment property for a more tailored solution. Is No Cost Refinancing Right for You?Deciding if a no cost refinance is right for you depends on your financial situation, goals, and how long you plan to stay in your home.

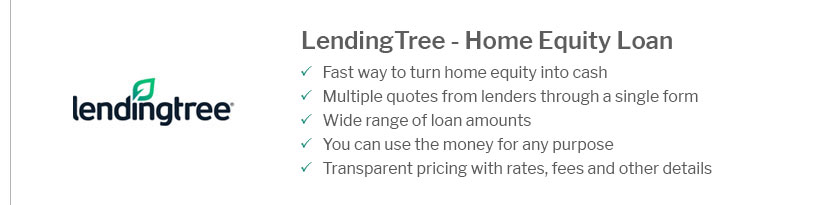

Additionally, those considering other financial avenues might look into options like a refinance home equity line of credit to access home equity. Frequently Asked QuestionsWhat are the typical costs covered by a no cost refinance?Typical costs covered include appraisal fees, credit report fees, and title insurance. Lenders might cover these by either absorbing them or adjusting the loan terms. Can a no cost refinance affect my credit score?Yes, as with any credit inquiry or new loan, a no cost refinance can temporarily affect your credit score. Ensure consistent payments to mitigate any negative impact. How can I find the best lender for a no cost refinance?Research and compare offers from multiple lenders. Look for transparency in costs and evaluate the long-term impact of any rate changes. https://www.bankrate.com/mortgages/is-no-closing-cost-for-you/

In a typical mortgage refinance, the borrower pays a lump sum at closing to cover costs such as the lender's origination fee and appraisal fees. https://www.thetruthaboutmortgage.com/no-cost-refinance-loans/

No cost refinance: 5.875% mortgage rate, NO fees. Standard refinance: 5.375% mortgage rate, $7,500 in fees. Imagine you're able to qualify for a $500,000 loan ... https://www.jvmlending.com/loan-types/no-cost-refinance/

A no cost refinance allows you to refinance your home without having to pay any money out-of-pocket for your closing costs. It is a great option for homeowners ...

|

|---|